Aircraft Sales Tax Illinois - Members earn more Save more - Get more by becoming a pilot - Click here

Aircraft buyers face many challenges. One of these, state tax planning, is often left to the last minute – it should be the first consideration for buyers when purchasing an aircraft. Not only do you need to understand all the taxes that affect aviation and operations in your home state, but you also need to understand the tax conditions in other states where you fly or have business interests. have Each state has its own way of interpreting its own laws as well as neighboring states.

Aircraft Sales Tax Illinois

Photo of the pilot on the airframe of the Challenger 601, preparing for training. Wichita, United States of America

Gift A Subscription To Model Airplane News

These taxes include, but are not limited to, sales taxes, taxes, registration fees, advertisement value taxes, property taxes, license fees/taxes, transaction fees, and fuel taxes.

Sales tax is levied by the state on the sale price of private government property in which the sale is made. In most cases, sales tax is paid by the buyer and collected and remitted to the seller's state.

Alaska, Montana, New Hampshire and Oregon have no state sales tax. Delaware does not have a state sales tax, but it does have a gross receipts tax, which is levied on the gross receipts received by a wholesaler for goods supplied within the state. However, aircraft weighing 12,500 pounds or more are exempt. Massachusetts, New York and Rhode Island do not tax aircraft, and Connecticut does not impose a sales tax on aircraft weighing more than 6,000 pounds. Mississippi, Oklahoma, North Dakota, South Dakota, Illinois and Virginia impose a special tax on aircraft instead of the general sales tax. This tax may be less than the state sales tax. South Carolina and North Carolina tax airplanes at $300 and $2,500, respectively.

Many states have tax exemptions on the sale of aircraft. Some common exemptions/exemptions to state sales tax are "common carrier," "flyover," occasional sales, sales for sale, and related entity transfers. In addition, many states have a trade-in credit that reduces the tax base.

Rep. Tom Dent: Overview Of Aviation Issues In The 2022 Legislative Session

As with all discounts and exceptions, they may be applied in a limited manner. Additionally, exemption criteria will vary from state to state. A common carrier discount is a good example. Some states require that airplanes be operated under a commercial operating certificate, such as Kentucky. In Colorado, only an aircraft operated by a commercial airline carrying cargo or passengers on a regularly scheduled flight.

Sales tax also applies to aircraft maintenance parts and services. However, some states offer discounts for the sale of certain parts and services. Florida, Tennessee and Arkansas have exemptions for aircraft that meet weight categories or are removed from the state within a certain period of time. Generally, if the service cost is used for the repair and maintenance of the aircraft and is recorded on the invoice, it is exempt from state sales tax. but still.

An aircraft is generally subject to the tax laws of the state in which the aircraft is located. Much has been said about avoiding sales tax by operating an aircraft in a tax-free state or in a state where the flight is exempt. However, while you may be able to avoid state sales tax, the use tax laws of the state where the aircraft is located become a major concern.

A use tax generally applies to the use, storage, or use of tangible personal property in a particular state. Any item that can be brought into the state can be subject to consumption tax. Because such a tax is so difficult to enforce, most states focus their efforts on big-ticket items like airplanes. More than 90 percent of states have a compensatory use tax as a component of their sales tax. So, how does the state know that the plane is in the state? While most states require their aircraft to be registered with the state, other states obtain their registry information from the FAA. Sometimes it's as simple as a tax collector sitting at the airport taking out an N number, which can be checked against government records. States are becoming more aggressive in taxing aircraft.

Arizona Drops In Pwc Ranking Of Best States For Aircraft Industry

Aircraft registration fees are assessed at the state level and are usually annual or biennial fees. The method of assessment — and the amount — varies by state. Some states use aircraft registration fees only to track new aircraft registered in the state and the fees are relatively low. In most cases, the aircraft registration fee is dedicated to the aviation/transportation fund, while other states use the fee to fund domestic aviation programs.

Personal property taxes are generally assessed at the local level, usually in the county where the aircraft is based, and are always an annual tax. Unlike aircraft registration fees, these personal property taxes are usually significant. Most states charge an aircraft registration fee or personal property tax. Both are used in Virginia, Alaska, and Utah. However, Colorado, Delaware, Florida, Maryland, New Jersey, New York, Pennsylvania, and Vermont are also excluded. Unlike aircraft registration fees, personal property taxes are not dedicated to the aviation/transportation fund.

Most buyers are aware of state and local sales taxes, but aircraft registration fees and personal property taxes can be easy to overlook. These taxes and fees are imposed annually and can be significant, so understand how and when they apply.

Aviation fuel tax is levied in 47 states, either through an excise tax, a sales tax, or both. This is in addition to the federal fuel tax. Texas, Connecticut and Rhode Island do not tax aviation fuel. There are some exemptions to these fuel taxes, but they are generally limited to commercial operations, federal and state governments, and agricultural operations. It is wise to check available tax deductions. More than 30 states allocate all or part of the revenue collected from fuel taxes to the Aviation/Transportation Fund to support general aviation and non-federally funded projects.

Biden Says U.s. To Ban Russian Flights From American Airspace

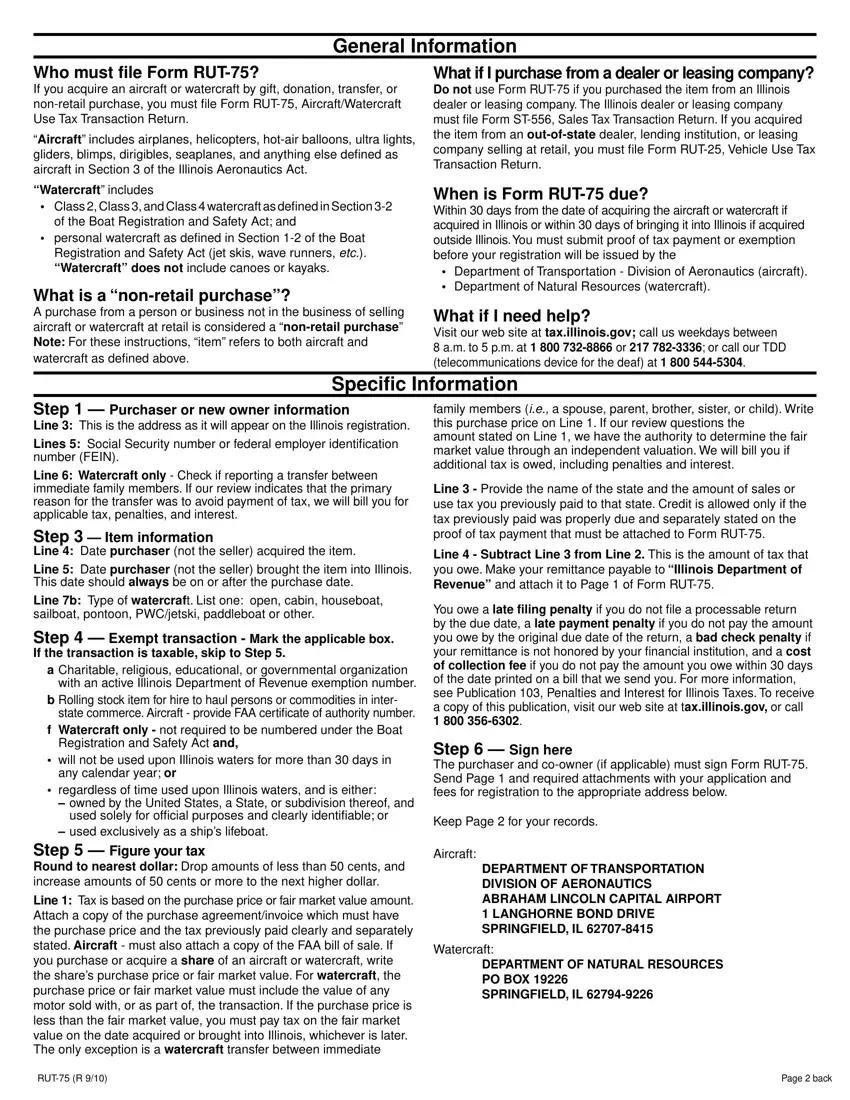

Certain taxes and fees levied on aircraft are not included in the name of registration or property tax. Instead, they are called license taxes, flat fees, transaction fees or excise taxes. These taxes and fees can be significant, such as 0.5 percent of fair market value in the case of the Arizona license tax. 556 Instructions for Selling from Illinois Locations General Information Who Must Receive Form ST-556 If you sell items that must be registered under the Illinois State Vehicles, Watercrafts, Airplanes, and Mobile Homes title, you must report these sales. ST-556 Sales Tax Transaction Declaration. Note that if you are a tenant from a state that sells such items at the end...

Submit Form 556 by email, link, or fax. You can download, export or print it.

Customizing your paperwork is easy with our comprehensive and intuitive PDF editor. Follow these steps to easily print Illinois Form 556 online:

We have more versions of the printable Illinois Form 556. Choose the right Illinois Form 556 printable version from the list and start editing right away!

Look Up Illinois! How To Find Out Where That Airplane Is Heading

We have answers to our customers' most popular questions. If you cannot find an answer to your question, please contact us.

Who should file Form ST-556? If you sell Illinois retail items that are of a type that must be registered by an Illinois government agency (or cars, watercraft, airplanes, trailers, and mobile homes), you must report those sales on Form ST But should be given. \u2011556, Sales Tax Transaction.

You can print your return from this screen by clicking on the "Print" button. If you do not have a verification code, call Taxpayer Assistance at 1-800-732-8866 or (217) 782-3336. You can also request a copy of your tax return by completing and submitting Form IL-4506.

Form IL-1040 is an official document that taxpayers fill out to determine a credit or refund. It is divided into sections and forms the basis of the personal income tax return.

Race For World's First Commercially Viable Electric Plane: The Battle For \

Unfortunately, you cannot attach an electronically filed tax return. TurboTax does not provide this functionality, in part because the IRS and state electronic filing systems cannot recognize them as tax forms and cannot verify their accuracy.

St-556 form indiana st-556 form instructions tax.illinois.gov form st-556-lse st-556 rut-25 or rut-75 illinois secretary of state official form: vsd 190 st-556 vs st556x

Copies of this form should also be sent to OFEA's central engagement staff.

Illinois state sales tax, illinois sales tax registration, illinois sales tax nexus, illinois sales tax rules, tax lien sales illinois, vehicle sales tax illinois, illinois sales tax rate, internet sales tax illinois, illinois sales tax id, illinois sales tax application, illinois sales tax exemption, tax deed sales illinois

0 Comments